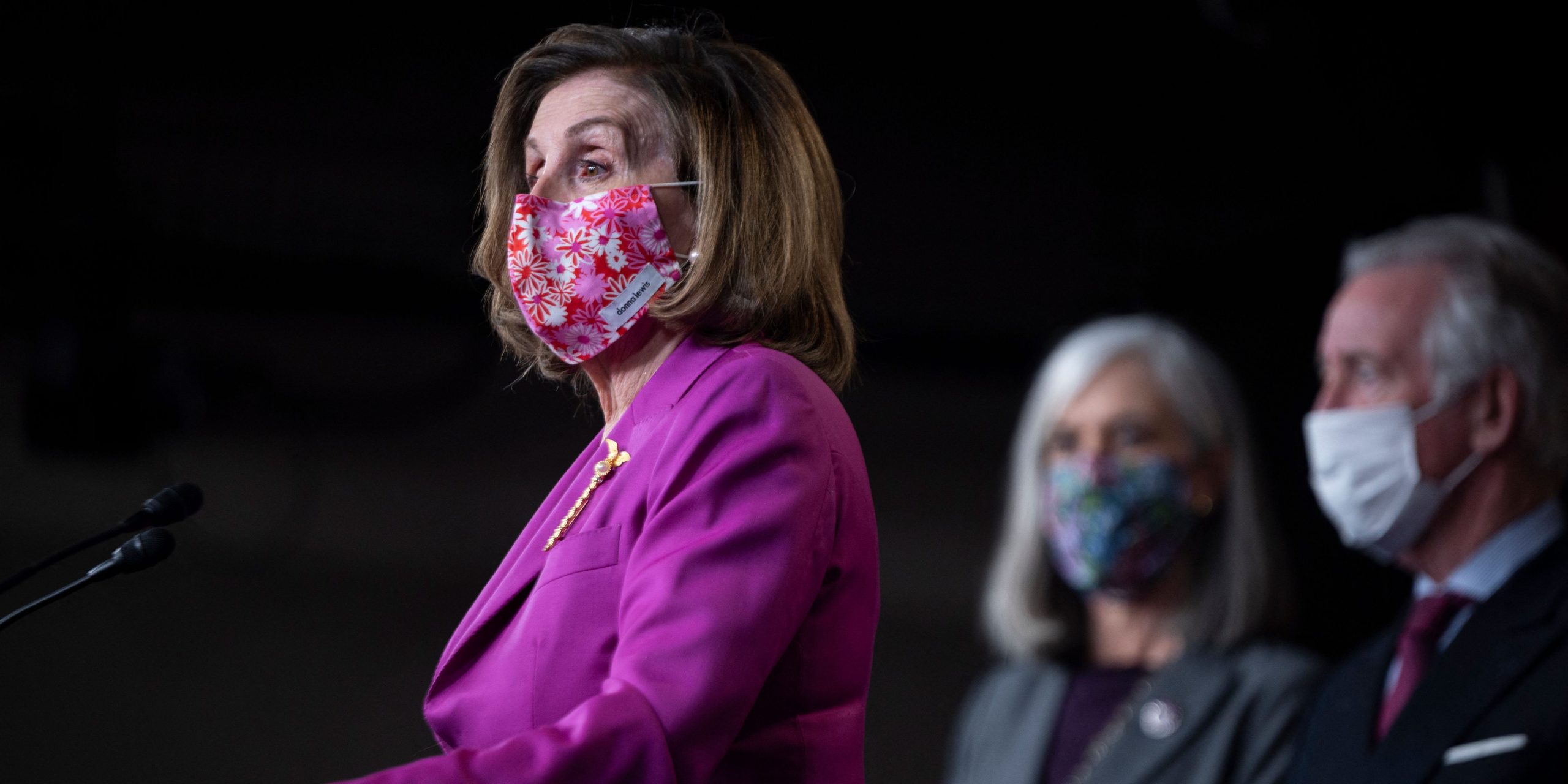

ANDREW CABALLERO-REYNOLDS / Getty Images

Sign up for Insider Investing for your weekly markets analysis.

Here's what you need to know before markets open.

1. Global stocks rise after the House passes Biden's $1.9 trillion stimulus package and fears of inflation subside. Government bond yields fell, easing investor worries about stock valuations.

2. World's biggest asset manager says gold is failing as a hedge against inflation and stocks. BlackRock is unimpressed by the yellow metal's performance.

3. The son of 'gold bug' and bitcoin critic Peter Schiff moved 100% of his portfolio into the cryptocurrency. One commentator said at least someone in Schiff's family was growing their wealth this year.

4. GameStop stock hit with 6 trading halts as volatility spike results in $176 daily trading range. It was another wild day for the video-game store stock on Wednesday.

5. The COO of Goldman Sachs says client demand for bitcoin is rising as the cryptocurrency flirts with record highs. John Waldron said: "We continue to evaluate it... and engage on it."

6. Earnings expected. Rolls-Royce posted a heavy loss, and DocuSign is up in the US.

7. On the data docket. Traders will be focused on weekly jobless claims.

8. SPAC skeptics are wagering billions against the 'blank-check' revolution. Exclusive data shows these are the 20 most-shorted SPACs in the market right now as many see a bubble swelling.

9. A fund manager who's beaten 95% of his peers over the past 5 years broke down his favorite growth opportunities. Matt Moberg also shares with us 3 e-commerce stock picks for one of the most 'misunderstood' parts of the market.

10. Biden's stimulus roll-out is going to catalyze a flood of consumer spending. Jefferies says buy these 36 stocks poised to surge this spring as that happens.